CAPSTONE DESIGN SHOWCASE 2021

-

DAYS

-

HOURS

-

MINUTES

-

SECONDS

COMING SOON

COMING SOON

Team members

Eremus Soh Juin Wey (ESD), Douglas Poh Soon Kiat (ESD), Jessica Davinia Layardi (ESD), Wong Wei En Matthew (ISTD), Hansing Junitra (ISTD)

Instructors:

Norman Lee Tiong Seng, Ying Xu, Nuno Ribeiro

Writing Instructors:

Teaching Assistant:

Project Summary:

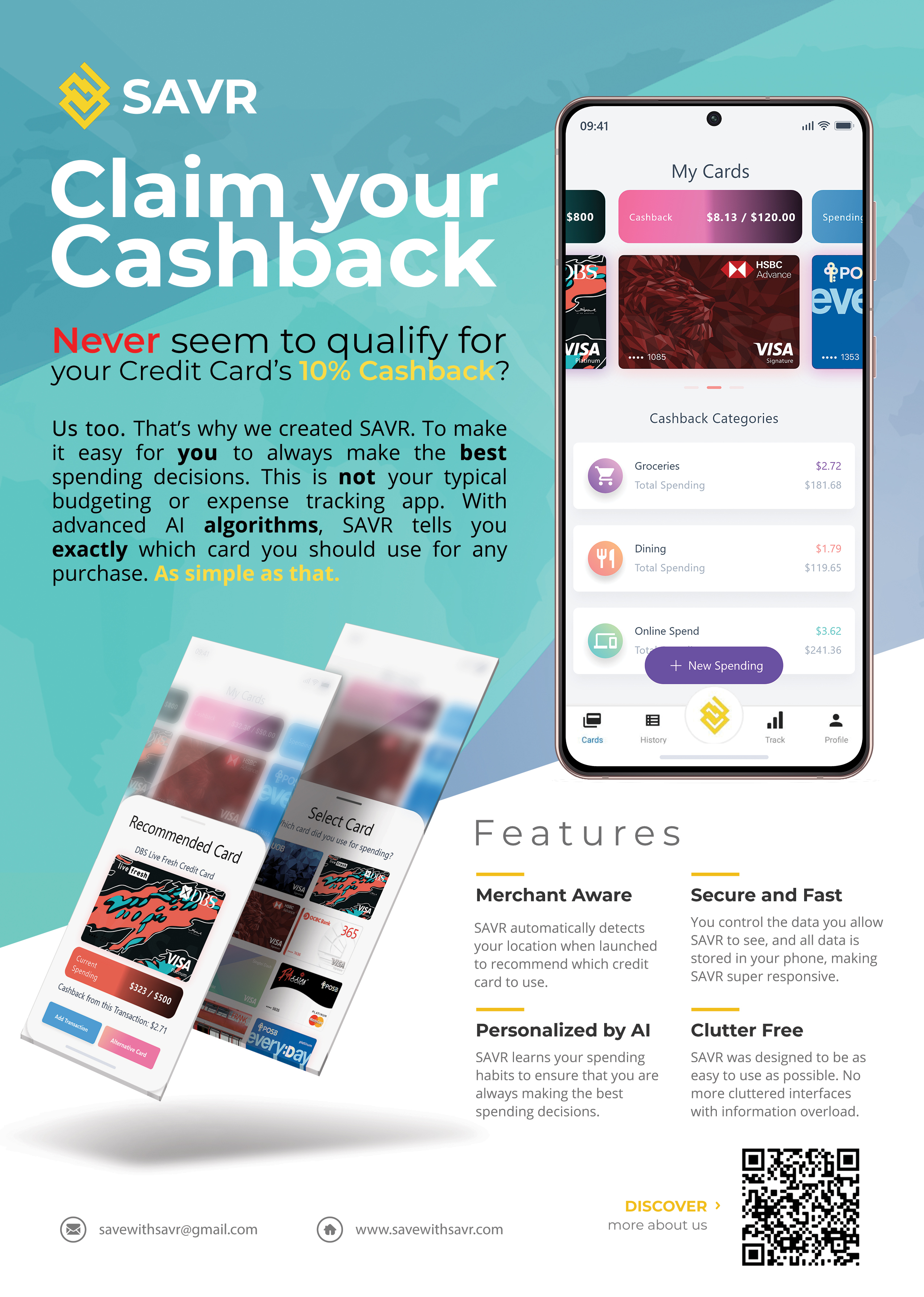

SAVR aims to enable users to keep track of their spending on the different credit cards they own, allowing them to keep track of how close they are to achieving their cashback criteria. Using our advanced AI/ML algorithms, SAVR will also automatically recommend the best card for any purchase.

Tired of always feeling frustrated at the end of the month when you receive your credit card statement but realize you did not qualify for that 8% cashback that you thought you should have gotten?

You no longer have to stress yourself out or fiddle around at the checkout counter trying to figure out which card to use or whether you have met the criteria of a particular card’s rewards scheme.

Standing in line about to make a payment but unsure which credit card to use that qualifies for the highest cashback? Just launch SAVR.

We’ll also keep track of all your spendings on each of your individual cards that you have so you know exactly how close you are to fulfiling those pesky T&Cs

At the end of the month, just enjoy that sweet cashback from all your different credit cards but without the hassle of trying to remember which card to use :-)

All of your sensitive personal financial and banking data will be stored locally and also offline to minimize any chance of data leaks.

Syncing to your iBanking Account is done via an established Financial API that adheres to the highest international standards of privacy and security which is ISO/IEC 27001:2013 certified and PCI DSS compliant. The API goes through regular internal and external vulnerability assessments, security audits and penetration tests, executed by certified security service providers.

So rest assured that all your data is #safewithsavr.

Make your life easier by importing your Credit Card transactions via iBanking so you don't have to manually input each time you make a transaction. Rest assured that this entire process is done via an established financial API with top tier security and encryption so all your sensitive information won't be at risk of being exposed openly. SAVR only retrieves your credit card transaction history and nothing else so your privacy is guaranteed.

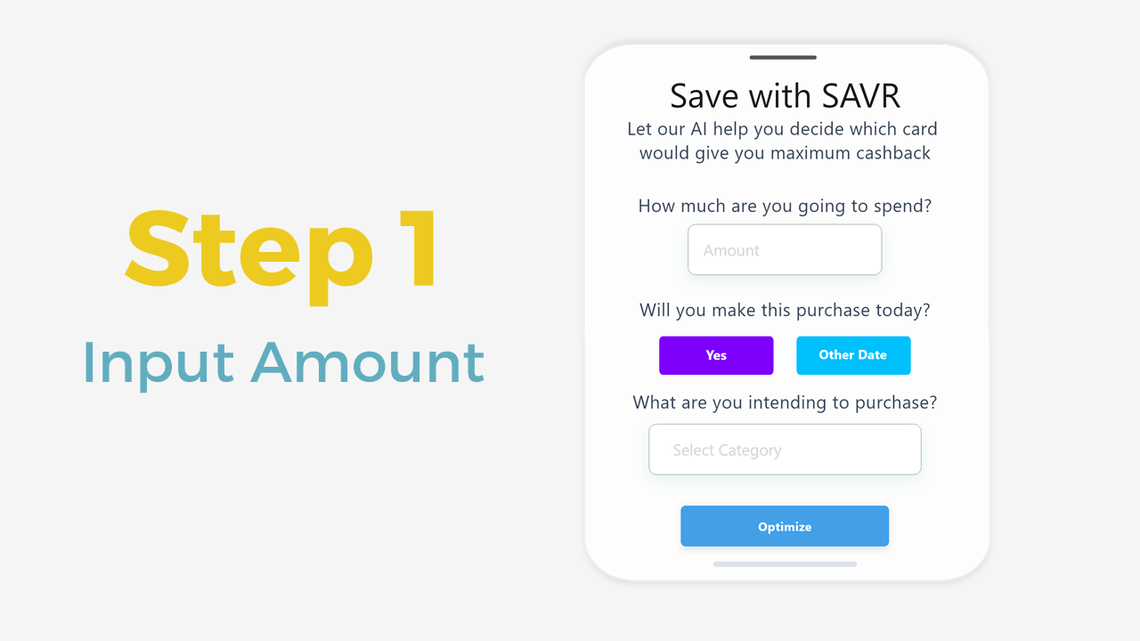

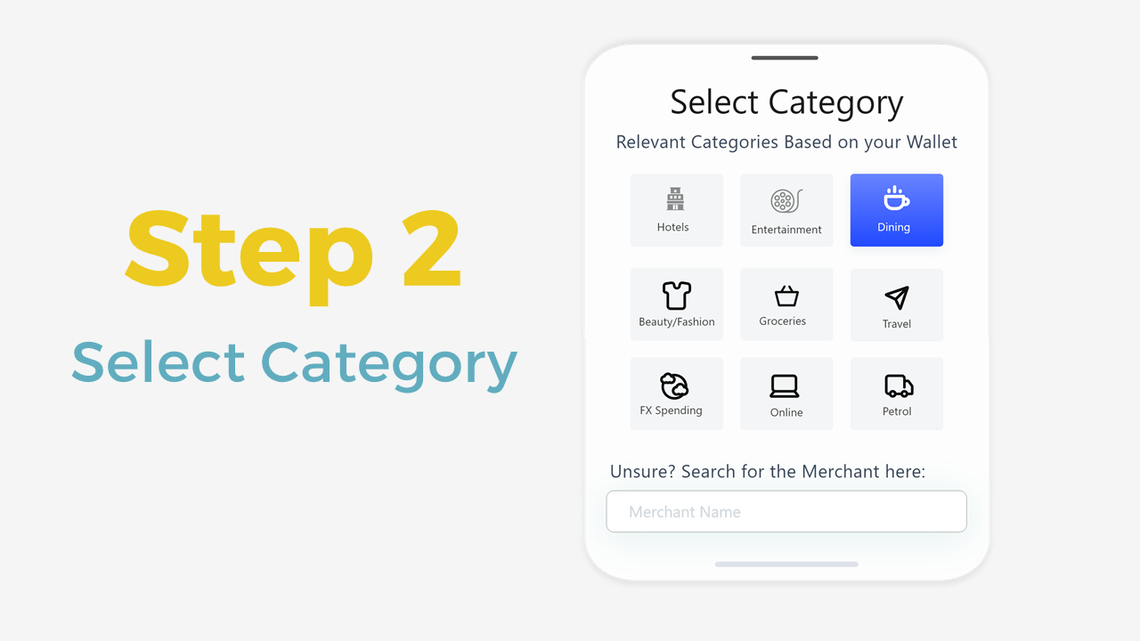

Want to add transactions manually or don't want to sync via iBanking? No fret as we have also completely redesigned the entire process of expense tracking. No longer do you have to click on every single field and key in an excessive amount of information. SAVR makes it easy to add transactions quickly, only requiring the bare minimum amount of input from your side. All other details are automatically figured out by SAVR's intelligent AI or based on your past activity so adding transactions will be a breeze.

Deleting transactions is even easier. All you need is a swipe.

SAVR redefines the way you keep track of your expenses. Expense tracking is no longer for the enthusiast or financially savvy. Everyone and anyone can easily #savewithsavr.

Check out what some of our initial users have to say:

"The recommendation works pretty fast and is pretty accurate, like its reading my mind just that I don't have to think so hard anymore."

- Alan, 41, Accountant

"Everything is so clean and simple and easy to use! Helps me to start a habit to keep track of my own spending so I can do my budgetting every month now that I'm starting my job."

- Sally, 22, Fresh Graduate

"It's so much trouble to have to keep track of which cards I have and which card is best for which category. Even if I do, I usually just spend all the relevant transactions onto one card, only to realise at the end of the month that I exceeded the spending amount by A LOT. Maybe its just that I'm bad at estimating my pre existing spend cause its so many small transactions day in day out. But with this app, everything is now a lot more easier and even if I exceed the maximum rebate cap, its only by a little bit so I can still make up for it with other cards and get those rebates."

- Adrian, 54, Manager

With over 90% accuracy for our algorithm and up to 5 pickups a day/user, SAVR is not your typical budgeting or expense tracking app. You can now know exactly which card you should use for any purchase. So let us help you save time, save money, #savewithsavr.

As simple as that | Claim your cashback

Launching SAVR for the first time? Setting up your profile is a breeze with just a few taps needed to add all your cards into the wallet. No complicated onboarding tutorial with overloaded features and screens that you have to go through.

Everything is kept simple. #startwithsavr

Editing and updating any details from your transaction history is super easy with additional features to help you save time and save money.

Looking to categorize a transaction? With just one click, all similar transactions will be updated accordingly and SAVR will remember that new categorization so you don't ever have to key it in manually again the next time you make that transaction.

All these changes are also dynamic and would update in real-time. So the rebates and spending progress you see for each card is always accurate.

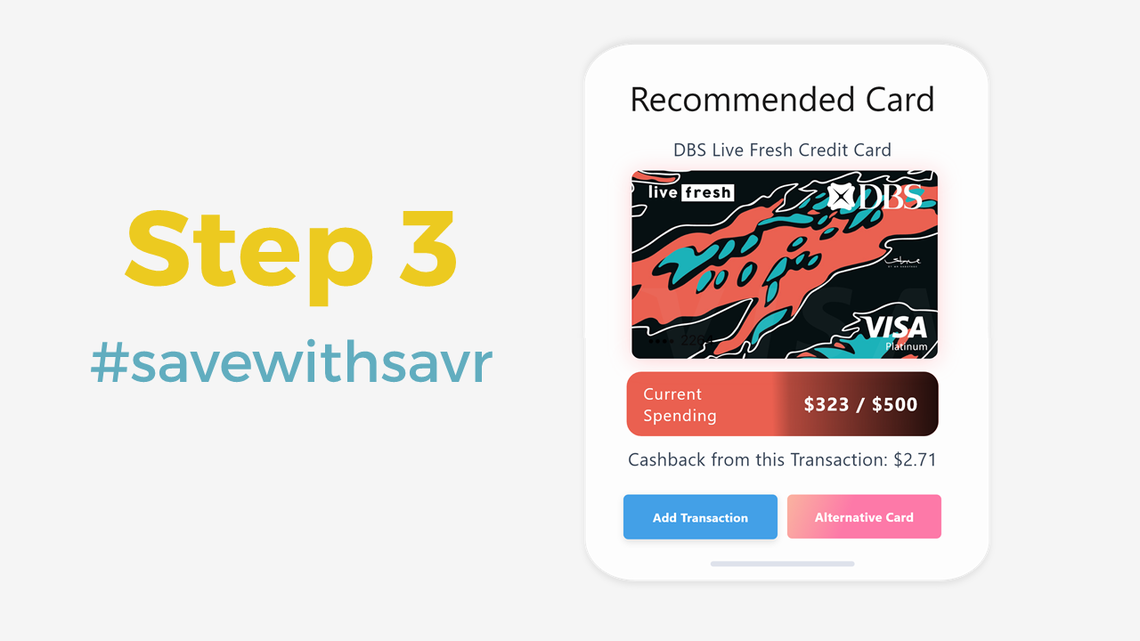

#savewithsavr using our incredible SAVR.AI which recommends you the best card for whatever spending you intend to make. SAVR is even personalized to suit you, based on your past spending habits, our algorithm considers not only the different cards you have in your wallet but also the remaining duration in the statement month and your current spending progress in order to make it easier for you to claim your cashback.

With just three simple steps, the best card for your purchase will be displayed, along with your current spending progress and cashback from the transaction. Don't have the recommended card with you at the moment? Don't worry, we've been there too. SAVR will suggest the next best alternative so you can always be sure you are making the most informed and smartest financial decision.

No longer do you have to resort to complicated optimization mathematics in your head while in the queue, or check your excel spreadsheet of transactions to make a decision.

Save time, save money, #savewithsavr.

TeamSAVR would like to thank our LeanLaunchPad Mentor, Alankar for his guidance and help throughout our entire customer discovery and validation process.

We would also like to thank the SUTD Entrepreneurship Centre for their support during our entire Capstone period as well as our Capstone Instructors, Prof. Norman Lee, Prof. Ying Xu, Prof. Nuno Riberio & Dr. Susan Wong for their valuable advice and pointers which were pivotal to SAVR's success.

Eremus Soh Juin Wey

Engineering Systems and Design

Eremus Soh Juin Wey

Engineering Systems and Design

Douglas Poh Soon Kiat

Engineering Systems and Design

Douglas Poh Soon Kiat

Engineering Systems and Design

Jessica Davinia Layardi

Engineering Systems and Design

Jessica Davinia Layardi

Engineering Systems and Design

Wong Wei En Matthew

Information Systems Technology and Design

Wong Wei En Matthew

Information Systems Technology and Design

Hansing Junitra

Information Systems Technology and Design

Hansing Junitra

Information Systems Technology and Design

Eremus Soh Juin Wey

Engineering Systems and Design

Douglas Poh Soon Kiat

Engineering Systems and Design

Jessica Davinia Layardi

Engineering Systems and Design

Wong Wei En Matthew

Information Systems Technology and Design

Hansing Junitra

Information Systems Technology and Design

© 2021 SUTD